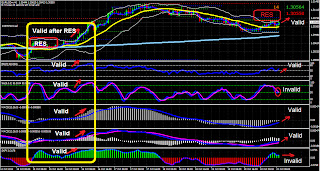

My this new strategy for beginners is very helpful. I explained all the indicators used in this strategy. Look at the chart below and then read all below that chart:

INDICATORS USED IN THIS STRATEGY

ASK+BID+SPREAD-INDI :-

This Indicator shows Ask, Bid and spread on the upper right corner. So easy to know the difference between Buy and Sell price. So before entry check out spread as well and try to choose low spread.

Bands:-

Bands are well known, It has 3 lines and price moves within that 3 lines. When these 3 lines expand that shows market is fast. So before you enter check out the lines and also the middle line plays an important role. In my strategy I coloured the middle line as Yellow. Avoid entry when 3 lines are close.

Support & Resistance Indicator:-

This is a very important indicator which U can use for breakouts. This indicator draws support/resistance on chart and we should know the value of support/resistance. So before you enter check out resistance/support as well whether the price is trying to break or going to rebound from that S/R.

EMA 3 (EXPONENTIAL MOVING AVERAGE ):-

This EMA plays an important role and U should focus on it to catch the signal. In my strategy I coloured this EMA as blue. This will indicate you to the right direction where the price goes. So before you enter check out the direction of this EMA.

MA 200 (SIMPLE MOVING AVERAGE ):-

This SMA is my favourite as it plays a very important role. I use this sometimes for Long term trade. So when U see Price crosses this SMA, just wait for the confirmation and then enter for long term.

RSI:-

RSI is a well known Indicator which directs U to the right direction where price goes. So before you enter check out the direction of RSI as well. In my strategy I put levels in this Indicator that are 20, 50 and 80. Above 50 is buy zone and below 50 is Sell zone. Above 80 indicates overbought condition and below 20 indicates oversold condition.

STOCHASTIC:-

This is almost similar to RSI but they are not same just the difination is almost same. U have to check out its direction as well before U enter. It has 2 lines one Pink and one Blue, so when Blue line crosses pink upward the pink line's direction will also be upward which means price goes up while downward direction of both lines means price is going down. In my strategy I put levels in this Indicator that are 20, 50 and 80. Above 50 is buy zone and below 50 is Sell zone. Above 80 indicates overbought condition and below 20 indicates oversold condition.

MACD:-

MACD is used to spot changes in the strength, direction, momentum, and duration of a trend in a stock's price. When U see zero level is crossed , there you have to focus. In this oscillator or indicator the blue line will also guide you to the right direction. Above/Below zero level if volumes are getting reduced that also tells you the direction towards zero level.

MACD Modified:-

This is also MACD and works similar as MACD but this Indicator has 2 lines one Pink and one Blue, so when Blue line crosses pink upward the pink line's direction will also be upward which means price goes up while downward direction of both lines means price is going down. U have to look at these lines and volumes as well.

SKFX:-

This is also almost similar to MACD and works almost similar as MACD . Green volumes above zero level indicate buy zone and Red volumes below zero level indicate Sell zone.This Indicator has 1 Blue line also, which indicates the direction of price where it goes. U have to look at this line and volumes as well.

=============================================================================

WHERE TO ENTER, HOW TO FIND SIGNAL?

As U read about indicators used in this strategy, so it will be easy for U to undersatnd now.

In this strategy I coloured all the important lines as Blue, so in simple words when U see all blue lines facing upward then U should know its Buy signal BUT to find strong signal U must wait for the cross between Middle line (Yellow one) of Bollinger Bands and 3 EMA (Blue one). If 3 EMA is crossing Middle line of Bollinger Bands Upward and the cross is valid then all blue lines will follow the direction of 3 EMA. If U find all lines in similar direction then only enter.

HOW TO AVOID POTENTIAL PROBLEMS?

When U find all lines in similar direction after a valid cross then U look at Support/Resistance near by if that is too close then wait for its breakout. ALSO avoid entry when 3 Lines of Bollinger Bands are too close which means market is slow.

WHAT TO DO WITH MOVING AVERAGE 200?

As I said in its description also that This SMA is my favourite as it plays a very important role. I use this sometimes for Long term trade. So when U see this SMA valid breakout ( when price crosses this line) just wait for the confirmation and then enter for long term.

CAN I ENTER WHEN I FIND ALL INDICATORS HAVE SIMILAR DIRECTIONS BUT JUST ONE HAS DIFFERENT DIRECTION?

My Answer is NO... I mean its not advisable..

HOW TO INSTALL THIS ALL?

Download Zip folder "KFX Simple Template for beginners"to your computer. Copy all of ex4 files means Indicators inside indicators folder which are 8 in numbers. Go to your Metatrader folder where it is installed. . Paste in expert/Indicators.

Now copy another tpl file ( KFX Simple Template for beginners), go to the same folder as U went before but this time U Paste in Templates not in expert/Indicators or expert/templates.

HOW TO APPLY TO YOUR CHART?

Right click on your metatrader screen( on chart), list will appear. Go to templates just below periodicity, another list will appear. Select and click on "KFX Simple Template for beginners" .

DOWNLOAD THE TEMPLATE AND WHOLE INDICATORS IN ONE ZIP FOLDER FROM HERE FOR FREE > http://www.4shared.com/zip/TPumxDcV/KFX_Simple_Template_for_beginn.html?